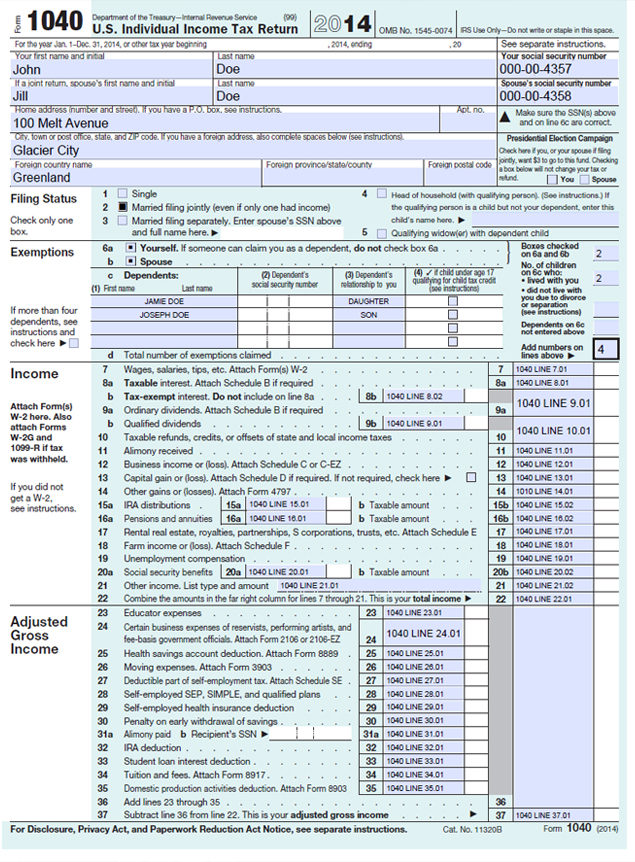

The United States Form 1040 Tax for Individuals can be considered a “Tax Score Sheet” and is required to be filed each year by individuals who are subject to United States income taxes. The Form 1040 has been used for tax returns since 1913, although its composition and line information has changed many times.

We have taken a blank FORM 1040 for 2014, and created a US FORM 1040 LINE REFERENCE SHEET. Beginning with 1040 LINE 7.01, Wages, salaries, tips, etc. We have assigned a FORM LABEL LINE for each line on the 2 page form. We are beginning a series of line definitions and commentaries on this website that will be labeled as follows:

FORM 1040 LINE 7.01 – Wages, salaries, tips, etc.

Various types of income and expense transactions are reported on the first page of Form 1040. We will use the term MONEY TRANSACTIONS since certain transactions such as gifts, inheritances, and money transfers are not taxable, and therefore are not included.

Line 7.01 – 37.01: Income and Adjusted Gross Income

MONEY TRANSACTIONS subject to US tax income tax include wage income, taxable interest and dividends, business income (or loss), farm income (or loss) capital gains on investment transactions, taxable pension payments, rental and royalty income, unemployment compensation, and taxable social security payments. Income from Trusts, Partnerships, S Corporations, and Limited Liability Companies is also included. This list is not inclusive

Taxable income activities are shown on the US FORM 1040 LINE REFERENCE SHEET, from Line 7.01 through Line 21.02. 1040 FORM LINES 23.01 through 35.01 refer to various items that are excluded from TOTAL INCOME to arrive at ADJUSTED GROSS INCOME.

Line 37.01 is labeled ADJUSTED GROSS INCOME, a TAXSPEAK term. Many individual calculations of your income tax, and special exclusions are based on your AGI (Adjusted Gross Income), and in some cases MAGI (Modified Adjusted Gross Income).

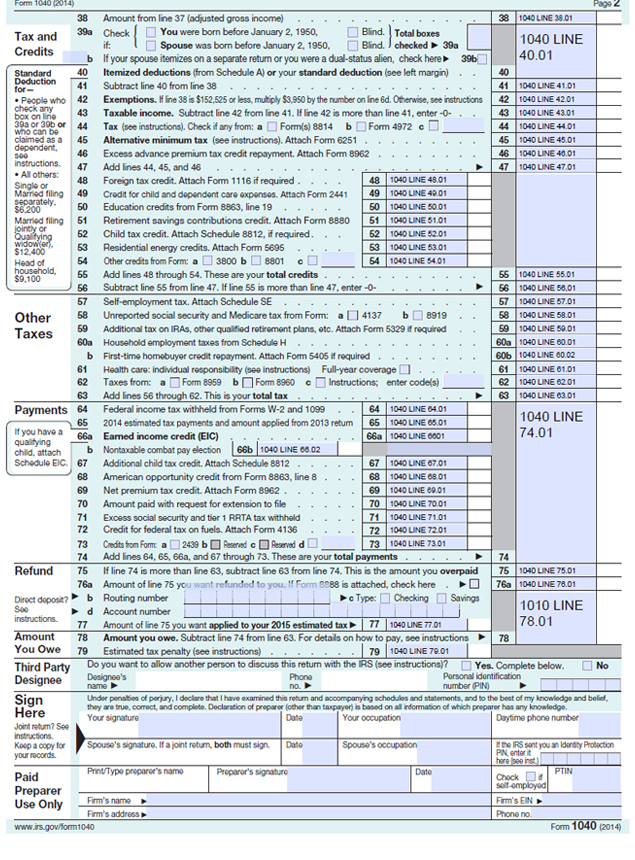

Line 38.01 – 56.01: Tax and Credits

The line labeled 1040 LINE 43.01 is labeled TAXABLE INCOME.

INCOME TAXES BEFORE CREDITS is the sum of LINE 44.01 and Line 45.01. This presentation is confusing, since the real tax is the greater of the ALTERNATIVE MINIMUM TAX as computed on FORM 6251 or LINE 44.01. Form 1040 shows the regular tax plus the difference between the regular tax and the ALTERNATE MINIMUM TAX. 1040 LINES 48.01 THROUGH 54.01 list various credits that reduce your income tax liability. There is a significant difference between an AGI EXCLUSION, a page 2 itemized or standard deduction and a page 2 tax credit.

For example, if you have taxable income of $100,000 and AGI EXCLUSIONS of $30,000, this will reduce your taxable income by $30,000. If your average tax rate is 28 percent, the income tax will be reduced by $8,400. A tax credit reduces your income tax dollar for dollar. For example, a $2,000 tax credit would reduce a tax liability of $16,000 to $14,000 whereas a $2,000 AGI EXCLUSION would reduce the tax liability by 28 percent times $2,000 which is $ 560.

1040 FORM LINE 56 is the amount of tax liability after subtracting the total credits summed on LINE 55. You will note that if the credits exceed the taxes shown on LINE 47, there is no net tax due, or a net credit in excess of the tax liability.

LINES 57.01 – 63.01: OTHER TAXES

LINES 57.01 through 62.01 cover OTHER TAXES, which are taxes not directly based on taxable income. They include self employment social security and Medicare taxes, withholding and social security taxes on household employees, Affordable Care health taxes, and additional Medicare and income taxes on “INVESTMENT INCOME.”

LINES 64.01 – 73.01: Payments

The FORM 1040 section labeled “PAYMENTS” is confusing regarding some of the constituent lines FORM LINE 64.01 through FORM LINE 73.01. Contrary to the zero tax liability no pay credit results on the credits summed in LINE 55.01, the credits shown in LINE 66.01, 67.01, 68.01, 69.01, 72.01, and 73.01 will be paid to the taxpayer even if there is no tax liability prior to the credits and payments.

1040 FORM LINES 64.01, 65.01, 70.01 represent cash payments against the income and other tax liabilities. 1040 FORM LINE 75.01 shows an overpayment against the tax liability; 1040 FORM LINE 78.01, shows the net tax liability unpaid. If the liability payments have not been made on a timely basis, there may be an Estimated Tax Penalty on 1040 FORM 79.01.